The FAMLI program ensures Colorado workers have access to paid leave when life circumstances force them to choose between earning a paycheck, or taking care of themselves or their family. Eligible employees may receive up to twelve weeks of leave. Those who experience pregnancy or childbirth complications may receive up to an additional four weeks.

FAMLI Leave benefits are available for twelve weeks per year, beginning the first day of your approved leave.

My FAMLI+

My FAMLI+ is the portal where Coloradans can apply for FAMLI benefit payments. Remember, if you’re applying for leave up to 30 days in advance of your leave start date, you must log into your account or call the contact center to let us know when your leave has officially started. Visit our My FAMLI+ page for how-to videos and a step-by-step User Guide for Claimants to walk you through the process.

Reasons to take FAMLI Leave

Colorado workers can apply for FAMLI leave for the following reasons (click each icon for additional information):

FAMLI is for Colorado Workers

Most Colorado workers are eligible for FAMLI benefits, including self-employed individuals, independent contractors, and employees of local government employers that have opted out. Most Colorado employees will become eligible to take paid leave after they have earned at least $2,500 in wages. These wages must be subject to FAMLI premiums over a period of roughly the last year.

How FAMLI Works

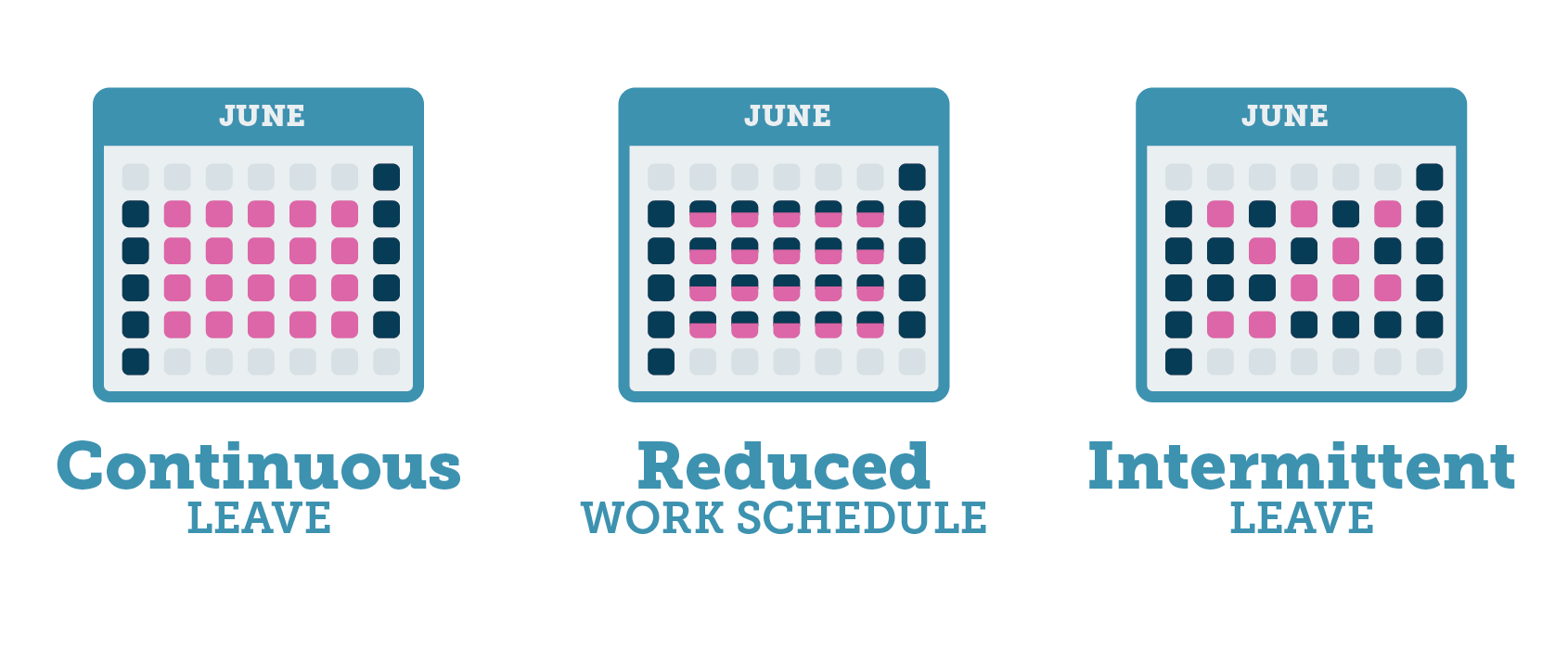

FAMLI leave may be taken continuously, intermittently, or in the form of a reduced work schedule. (Click here for additional information on the different ways FAMLI leave can be scheduled and used.)