Employer FAQs

General Program Questions

- Am I responsible for paying my employees wages while they are on leave?

The FAMLI program is a social insurance program and provides wage replacement for qualifying life events. Your employees will receive FAMLI benefit payments directly from the Division through a debit card or direct deposit.

As the employer, you don’t have to pay your employee their regular wages while someone is on leave and receiving FAMLI benefit payments. You should pay your employee for any previous pay periods they worked as scheduled.

Employers should also pay any portion of the employee's (and their dependents) health insurance benefits you normally cover; you are required to continue. You may choose to require the employee to continue to pay their share of their contribution to these benefits while they are on leave.

Local government employers that opt-out of the FAMLI program are not required to maintain health insurance benefits during FAMLI leave for their employees who opt-in to the program. See C.R.S. 8-13.3-509(8). However, while the FAMLI Act does not require a local government employer to maintain benefits in this situation, the terms of your specific benefits policies and/or other laws or regulations may require benefits to be maintained during paid family and medical leave.

- What do I do when my employee is on leave?

While an employee is on leave, employers must pay any portion of the employee's (and their dependents) health insurance benefits the employer normally covers. Employers may choose to require the employee to continue to pay their share of their contribution to these benefits while they are on leave. Because you are not paying your employee’s regular wages, you may have access to vacancy savings to spend as needed, like to hire temporary help for example.

Employees are not required to use earned paid time off (PTO) before taking leave under the FAMLI program, but employers may allow employees to use their accrued PTO to “top off” or cover the remaining balance of their typical weekly wage in order to “make whole” their take-home pay while on leave.

Employers that choose to “top off” FAMLI benefits are not required to supplement FAMLI benefits equally for all employees.

- What do employers do with temporary workers if they cannot afford to keep them on in addition to the permanent employee once that employee returns from leave?

This decision lies with the employer. As best practice, being honest with the temporary worker that their position may be limited to cover temporary leave for another employee will be helpful.

However, depending on the permanent employee’s circumstances and reason for taking leave, it is possible another federal law such as the American with Disabilities Act (ADA) would be relevant to the employee's new life circumstances, and a partial return to work/job sharing model may exist for a time. If time was spent onboarding the temporary worker, having them available during a transition or for another event may be helpful and can save time and effort

- I employ highly skilled workers, and a temporary worker would not be a solution for my business. What should I do while an employee is out?

Even a single employee vacancy can be a strain for a business' daily operations. Businesses may have other employees share the workload from the employee taking leave. While an employee is on leave, employers have access to vacancy savings. Employers may use vacancy savings from an employee on leave to provide a bonus or hazard pay for other employees who take on additional work.

- How long and how often can employees take FAMLI leave?

FAMLI leave is different from paid sick days and will require documentation of need in most cases before the benefit is approved by the FAMLI Division.

Most employees are eligible to receive up to 12 weeks of paid leave. Employees who experience pregnancy or childbirth complications may be eligible for up to 4 additional weeks of FAMLI leave. Employees with infants receiving intensive care in a medical facility may be eligible for up to 12 additional weeks of Neonatal Care Leave.

The FAMLI benefit can be taken multiple times per year. For example, if an employee took 6 weeks for a surgery in January, they would still be eligible to take another 6 weeks later in the year if there is another qualifying event.

- Which employees are eligible for FAMLI leave?

Most Colorado employees become eligible to take paid leave after they have earned at least $2,500 in wages within the State within the last 4 calendar quarters.

Self Employed Workers (1099 or Contract Workers) may also be eligible if they have opted into coverage and live and work in Colorado.

- How will I know how long an employee is eligible to be out on FAMLI-covered leave?

My FAMLI+ will send employers a determination notice whenever an employee applies for FAMLI leave and is determined to be eligible. These notices will include the dates the employee is eligible to take leave.

Employers can also check your HR Dashboard in My FAMLI+ Employer to track employees that are on FAMLI leave. The HR Dashboard allows employers to review the FAMLI leave statuses for all their employees in a single place. On the HR Dashboard, employers can request additional information, such as leave reason and leave amount.

- How will I know when my employee is expected to return to work?

The HR Dashboard allows employers to review the FAMLI leave statuses for all their employees in a single place. If you click on a claim, you can request additional information for each claim, such as leave reason and leave amount.

Claimants are also required to tell the FAMLI Division when they return to work, so they do not continue receiving FAMLI benefit payments while they are working.

- I work for a religious organization, or a non profit organization that is exempt from paying FUTA taxes under IRS section 501(c )(3), does that mean my organization is exempt from FAMLI?

Religious organizations, nonprofits or any other employer who may be exempt from FUTA premiums are NOT exempt from paying FAMLI premiums.

- I'm a partial owner in an S-Corp, and we have no other employees. Our S-corp business structure means that I pay no corporate taxes but instead pay my shareholders, who are responsible for the taxes due. Do I need to participate?

The structure of a business isn’t what matters for FAMLI compliance. What matters is whether the business has qualifying employees. If you have at least one qualifying employee, you will need to register with the Division, submit wage data and send in premiums on behalf of that employee. Under the FAMLI Act, an “employee” is any individual, including a migratory laborer, performing labor or services for the benefit of another, irrespective of whether the common law relationship of master and servant exists. The FAMLI Act’s definition of “employee” includes a two-prong exception:

If a person is both primarily free from control in the performance of their work, and that work is part of their independent profession or trade, then that person is not an employee under the FAMLI Act, and payments to them would not be subject to premiums. §8-13.3-503 (7) C.R.S.

Coordination of Benefits

- What about the federal FMLA? Can an employee take double leave?

The FAMLI program was designed to be able to run concurrently with the FMLA. For more information, see U.S. Department of Labor Office of Wage and Hour Opinion Letter FMLA-2019-1-A.

- Will FAMLI benefits run concurrently with short or long-term disability benefits?

Some disability policies may require exhaustion of FAMLI leave before making the disability benefits available, some may count FAMLI leave benefits toward the benefit obligations under the disability policy, and some may do neither or both.

Employers must give employees written notice of these restrictions in order for them to be enforceable. Employees should also ask their employers for details about their long-term and short-term benefits.

- Do I have to maintain health insurance for my employee while they're on leave?

Yes. Both the FMLA and FAMLI require employers to keep providing health insurance while an employee is on leave. During the leave, employees need to keep paying their part of the insurance cost. There are different ways employees can make these payments, including paying directly to the employer through a payment plan. You can find details in Regulations Concerning Coordination Of Benefits And Reimbursement Of Advance Payments 7 CCR 1107-4, Section 4.6.2.

If an employee and the employer agree on a payment plan but the employee doesn't make the payments during FAMLI leave, the employer can stop the health care coverage if they follow the FMLA regulations at The Family and Medical Leave Act 29 CFR 825.212, including giving notice and following specific timing. The employer must, however, bring back the coverage when the employee returns.

FAMLI also prohibit employers from interfering with employees' rights. So, the employer can't cancel coverage if it means they can't fully restore the employee's benefits when they come back. This would go against the employee's right to coverage restoration under FAMLI.

- How do employers administer FAMLI with existing leave/PTO policies?

Employers cannot require employees to use accrued vacation, sick leave, or other paid time off before or while receiving FAMLI. However, employers and employees can agree that an employee taking FAMLI leave can use accrued paid time off to “top off” their pay to make their benefit payments “whole.” Employees cannot, however, receive more in compensation than their average weekly wage.

Wages, Deductions & Premiums

- I received a notice for unpaid FAMLI premiums, but when I log in to My FAMLI+ Employer, my balance says $0.

Your dashboard in My FAMLI+ Employer will have the most up-to-date information on balances that are owed. If your dashboard says $0, then you can consider your account to be up to date, and you can disregard the notice that you received.

- Are FAMLI premiums pre-tax or post-tax?

FAMLI premiums should be considered post-tax deductions that do not reduce an employee’s taxable income.

- How do employers report FAMLI deductions from an employee's pay on IRS Form W-2?

The total amount withheld from an employee's pay for FAMLI premiums likely should be entered in Box 14. The Division encourages employers to seek advice from a tax professional on this subject.

- Do we need to deduct premiums from international J1s (and are they eligible to use the benefit) if they are only here seasonally?

Employers should pay premiums to the Division for every employee regardless of how long the employee works for them. This obligation starts the day the employee is hired.

Any individual who has earned $2,500 in wages that are subject to FAMLI premiums within the state of Colorado over the course of roughly a year, is eligible to apply for FAMLI benefits.

- How will FAMLI deductions apply if an employee is working more than one job at a time?

This depends on the type of jobs the individual is doing simultaneously. If both jobs are with employers that are choosing to deduct the employee’s portion of the premium and are not an opted out local government, then this individual would see the FAMLI deduction on each paycheck from each employer. When applying for benefits, this individual will have to identify which employers they are requesting to take leave from.

- Do we need to register if we have a third party payroll provider?

If your Third Party Administrators (TPA) has indicated that they will register on your behalf and manage your wage reporting and premium payments for your business, you do not need to register. Please confirm with your TPA exactly how they will be supporting your business in meeting your obligations.

If you want access to your My FAMLI+ Employer account after your TPA has registered on your behalf, your TPA will need to add you as a user. You can create your own user account in My FAMLI+ Employer, and request access to your business account if your business has already been registered.

Employers and TPAs now have the option of managing TPA-relationships and connecting their accounts directly in My FAMLI+ Employer. Visit our My FAMLI+ Employer page for user guides and how-to videos or give us a call at 1-866-CO-FAMLI (1-866-263-2654) for support.

- What happens to the employee’s contributions when they retire and/or leave the State of Colorado?

The FAMLI program is a social insurance program that both employers and employees contribute to. All contributions are added to the fund that pays out benefits.

The law currently does not allow an individual to withdraw contributions upon retirement or when leaving the state. The contributions made by that individual will remain in the social insurance pool after they retire or stop working in Colorado.

- I registered as a Sole Proprietor. How do I report wages for my employees?

Sole Proprietors who have employees should not be registered as Self Employed. You must register your account as an Employer / Company Administrator in order to report wages and pay premiums on behalf of your employees. If you need to change Employer type please call the Contact Center at 1-866-CO-FAMLI (1-866-263-2654) Monday–Friday 7:30 a.m.–4:30 p.m. (Mountain Time).

Remember: If you have at least one qualifying employee, you will need to register with the Division as an employer to submit wage data and send in premiums on behalf of that employee.

Payments

- How much do employers have to pay?

Overall, FAMLI premiums are shared between employers and employees based on 0.88% of wages. If you have 10 or more employees (nationwide), you may deduct up to 50% of the 0.88% premium as a standard payroll deduction.

If you have less than 10 employees (nationwide), you are not required to pay the employer share.

Employers are responsible for submitting wage reports and paying premiums. An employer will not be required to pay more than half the premium into the program from its own business expenses.

- How and when am I required to pay premiums?

Both employers and employees began paying into the fund in 2023. Employers need to submit to the Colorado Department of Labor and Employment both their share (if required) and their employee's share of the premium through an online system at the end of each quarter. These quarterly filings are similar to how most companies submit their unemployment insurance premiums.

The premium payment schedule is:

- April 30

- July 31

- October 31

- January 31

Responsibilities Under Proposition 118

Employer Type

Employer Premium

Employee Premium

No Premium

1–9 employees

✓

10 or more employees

✓

✓

Participating Self-Employed

✓

Participating Local Government Employee

✓

Nonparticipating local government

✓Nonparticipating Self-Employed

✓Employer with Private Plan

✓- Do I pay premiums through the FAMLI website or through the mail?

Employers will have several payment type options to submit their quarterly premium payments to the FAMLI Division:

- Online Payments through the My FAMLI+ Employer portal

- Online Bill Pay

- Payment via API

- ACH Credit

- Payment by Check

Please visit the Employers page and click on “Paying Your Premiums” for more details.

Private Plans

- Can an employer participate in FAMLI now and apply for Private Plan Approval later?

Yes, an employer may apply for private plan approval at any time after previously participating in FAMLI. If an employer plans to apply for Private Plan approval, they must continue to fulfill their FAMLI obligations until their private plan is formally approved by the Division.

- Will the private plan marketplace be changed frequently or will there be a defined time for the approved private plans?

Private plan insurance carriers have products available to employers that meet all of the FAMLI requirements. A list of approved carriers is published on our Private Plans page.

- What if an employer wants to change its Private Plan for another alternative private plan?

An employer must notify the Division, in writing, of any material change to an approved private plan at least sixty (60) days before the change is to take effect. However, if an employer is changing from one approved private plan to another approved insurance carrier’s private plan,

the employer must notify the Division, in writing, of the change at least thirty-five (35) days before the change is to take effect.

- How do I find an authorized surety company to secure a surety bond for my self-insured private plan?

- Go to the Colorado Division of Insurance (DOI) webpage.

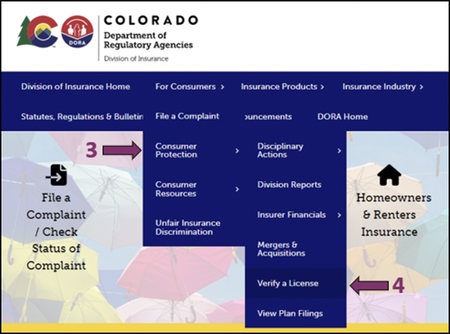

- Hover mouse over “For Consumers” in the bar at the top of the page.

- Hover over “Consumer Protection in the dropdown menu.

- Click on “Verify a License” - This will send you to a new webpage.

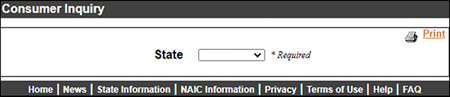

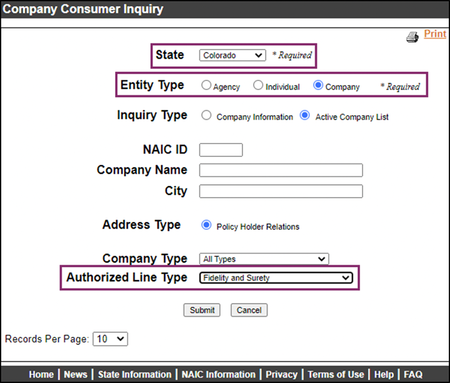

- Select "Colorado" for the state, then "Company," then select "Fidelity/Surety" under Authorized Line Type then click Submit to access a list of all insurers authorized to sell surety bonds in Colorado.

- When does the “Application Year” or “Benefit Year” start?

An employee’s “Application Year” is 12 months, measured forward from the employee’s first day away from work on FAMLI leave. For example, if the employee takes two weeks of FAMLI leave starting on February 3, 2026, the application year runs from February 3, 2026 through February 2, 2027.

The employee’s next application year will start on February 3, 2027, or the next date the same employee takes FAMLI leave, whichever is later. For example, the first application year ends on February 2, 2027, and the employee doesn’t need to take leave again until needing to bond with a new baby on September 1, 2027. The new benefit year runs from September 1, 2027, through August 31, 2028.

Counting Employees

- How do I count nationwide employees?

Your total nationwide employee count will be what determines whether or not you pay the employer share of the premium. You will only need to pay premiums for the employees who are localized in Colorado. For example, if you have 15 employees nationwide, and eight working completely in Colorado, you as the employer would be required to pay the 0.44% employer's share and collect and remit the 0.44% of the employee's share for each of those eight employees.

Remember: employers are required to update their total employee headcount every year. The Annual Total Employee headcounts are due by February 28. This annual reporting task will ensure that employers aren’t charged incorrect premiums each quarter. Starting in 2025: if your Annual Total Employee headcount is not updated by February 28, 2025, the FAMLI Division will assume you have 10 or more employees, and you’ll be required to send in 0.9% of wages each quarter.If your Annual Total Employee headcount is not updated by the end of February each year, the FAMLI Division will assume you have 10 or more employees, and you’ll be required to send in the full FAMLI premium each quarter. Here’s a handy refresher that dives deeper into how you count your employees.

- If an employee lives in Colorado but works in another state, is the employee subject to FAMLI? If an employee works in Colorado but lives in another state, is the employee subject to the FAMLI?

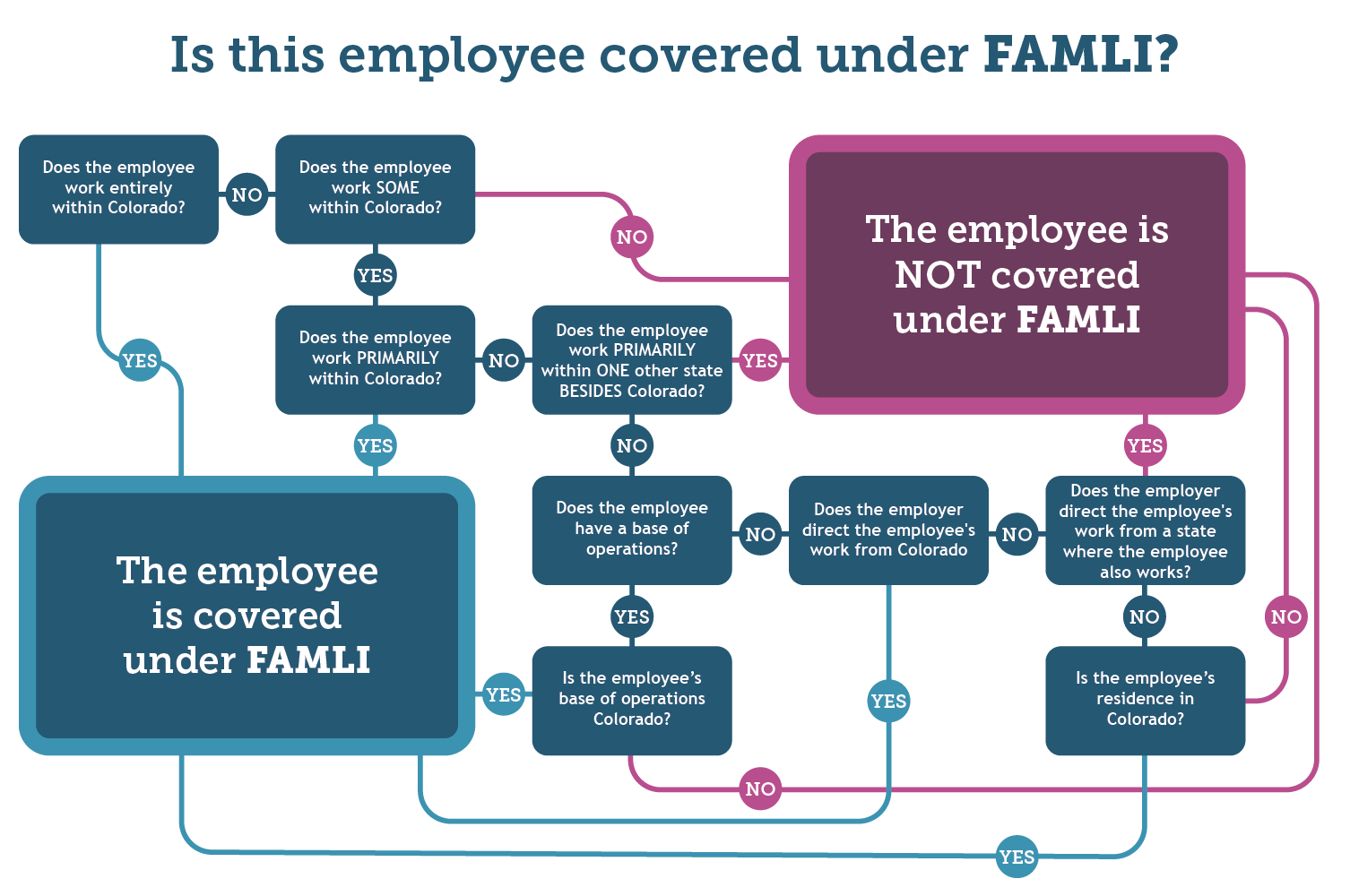

Under the FAMLI Act, most private sector employers must provide paid family and medical leave to their Colorado employees, whether through the state-run plan or through a private plan with equal or greater benefits and protections. An employee's wages will be subject to FAMLI premiums if:

- The employee's work is performed entirely within Colorado;

- The employee performs work both within and outside of Colorado, but the work performed outside of Colorado is incidental to the employee's work within Colorado, or is temporary or transitory and consists of isolated transactions; or

- The employee's work is not primarily localized in any state, but some work is performed in Colorado, and one of the following is true:

- The employee's base of operations is in Colorado, or if there is no base of operations, the place from which the employee's work is directed or controlled is in Colorado; or

- Neither the base of operations nor the place from which some part of the work is directed or controlled is not in any state in which part of the employee's work is performed, but the employee's individual residence is in Colorado. More information regarding localization can be found in the FAMLI Division's Premium Rules at 7 CCR 1107-1, Section 1.6.

We've created the following decision tree to help employers determine Colorado localization when it comes to employees being subject to FAMLI:

When determining whether the employee works primarily in Colorado or some other state, it is not sufficient to determine the amount of time they work in a state. An employee works primarily in a state only if the work performed outside that state is incidental to the work performed inside the state, or if the work performed outside the state is temporary or transitory and consists of isolated transactions. It is possible that an employee does not work primarily in any state.

For more detailed information about localization, please see the Premiums Rules at 7 CCR 1107-1, Section 1.6. if you still need help determining an employee's localization, please contact us at 1-866-CO-FAMLI (1-866-263-2654) Monday–Friday 7:30 a.m.– 4:30 p.m.