Small Business Corner

Every employer is required to register with the Family and Medical Leave Insurance (FAMLI) Division

Unlike the federal unpaid Family and Medical Leave Act (FMLA), every Colorado small business is required to engage with the Family and Medical Leave Insurance (FAMLI) Division if the business has one or more qualified employee(s).

What small employers need to know

Small employers with fewer than 10 employees are not required to pay the employer contribution to Colorado’s Family and Medical Leave Insurance (FAMLI) program. However, you will need to withhold your employees’ contributions and send them to the FAMLI Division along with wage data every quarter. Your employees will still be covered by FAMLI and will have access to benefits.

You will need to file quarterly reports through your My FAMLI+ Employer account.

What’s My FAMLI+ Employer?

My FAMLI+ Employer is Colorado’s employer services portal. This is where you, as an employer, will file your quarterly wage reports and pay your quarterly premiums.

What about S-corps?

The structure of a business isn’t what matters for FAMLI compliance. What matters is whether the business has qualifying employees.

If you have at least one qualifying employee, you will need to register with the Division, submit wage data and send in premiums on behalf of that employee. Under the FAMLI Act, an “employee” is any individual, including a migratory laborer, performing labor or services for the benefit of another. The FAMLI Act’s definition of “employee” includes a two-prong exception:

- If a person is both primarily free from control in the performance of their work, and that work is part of their independent profession or trade, then that person is not an employee under the FAMLI Act, and payments to them would not be subject to premiums. §8-13.3-503 (7) C.R.S. It's important to note that the Division may investigate claims that an employer has misclassified one or more employees as independent contractors.

How do I count my employees?

You will not owe the employer share of the premium if your business has fewer than 10 employees. Individuals who do not meet the definition of employee as described above, like sole proprietors or s-corp owners for example, should not be counted in your employee headcount.

When it comes to counting how many employees your business has in order to determine your premium liability, your headcount will be calculated by counting the number of employees (who fit the description above) you have on your payroll for a total of 20 or more calendar workweeks in the preceding calendar year. Employers will report their headcount during the initial registration process and once a year thereafter during the first quarter of each year.

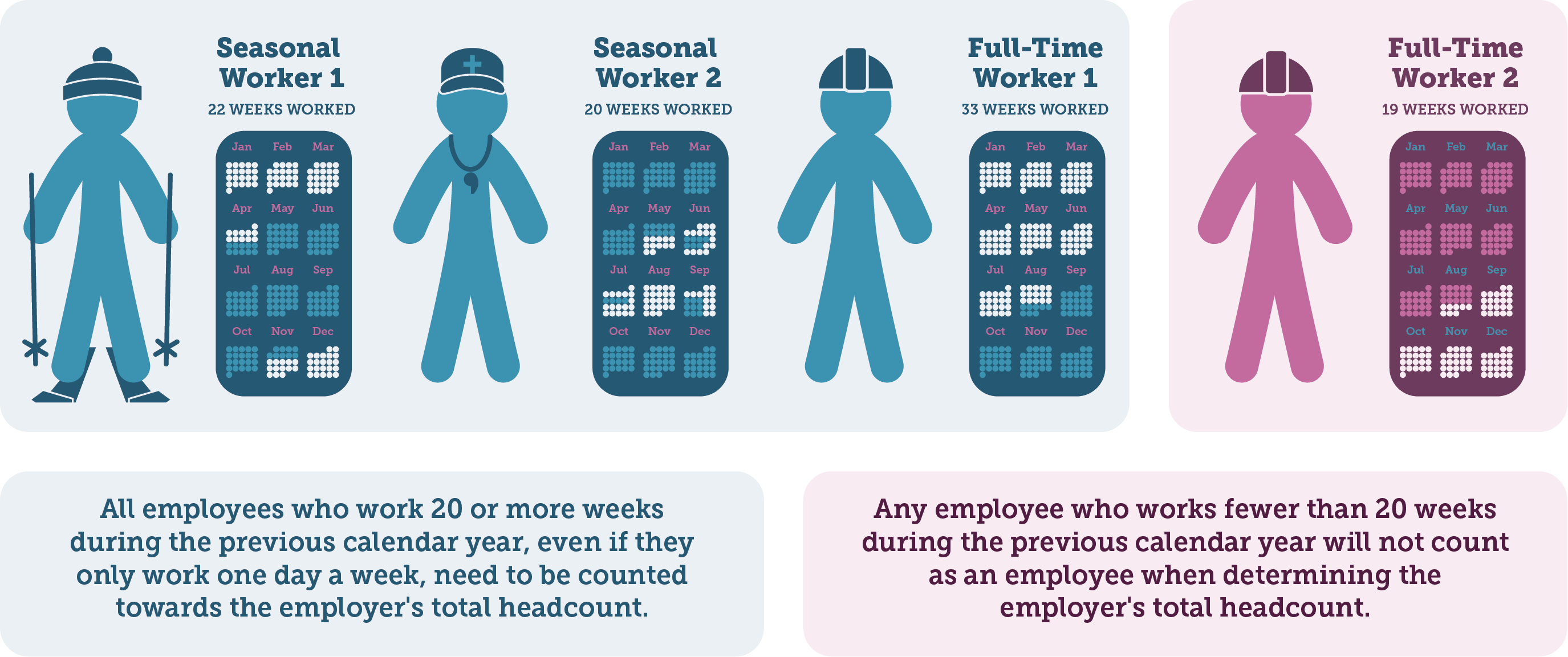

Here are some examples to explain how to count employees. The first two employees in this graphic are seasonal workers who work during 20 or more weeks throughout the calendar year. As you can see, the first worker meets the 20-week threshold, even though those weeks are not consecutive. And the second worker also meets the 20-week threshold, even though they sometimes work only a day or two in a given week. The third worker is a full-time employee who was employed for more than 20 weeks, and they would also be included, even though they stopped working for your business in August. All employees who work 20 or more weeks during the previous calendar year, even if they only work one day a week, need to be counted towards the employer's total headcount.

The fourth worker would not count toward your total headcount because they only worked during 19 weeks of the calendar year. Any employee who works fewer than 20 weeks during the previous calendar year will not count as an employee when determining the employer's total headcount.

As the employer, you would still collect premiums from each of these workers as soon as they are hired and regardless of if they are scheduled full-time or part-time. The 20-week concept should only be used to determine your headcount for premium liability.

Here’s how to comply with FAMLI requirements

You need to:

- Post the Required Program Notice.

- The Required Program Notice tells employees about FAMLI benefits as well as their rights and duties under the program.

- All employers must post the notice at each work site and provide a copy to all remote employees.

- It should be posted or sent out in the language(s) you use to communicate with employees.

- Download the Required Program Notice

- Register with My FAMLI+ Employer.

- You will submit the employee contributions (and the employer contribution if you have ten or more employees) through My FAMLI+ Employer. Visit the My FAMLI+ Employer page to learn more about this process.

- Give eligible employees time off. You must give your employees the time off if they are approved for leave by the FAMLI Division.

- Hold your employee’s job and role. If your employee has worked for you for more than 180 days, you must give them their job and position back if the position still exists when they return from paid leave.

You don’t need to:

- Pay the employer portion of the FAMLI contribution (if you have fewer than ten employees).

- Pay your employees while they’re on leave. The FAMLI Division pays your employees a portion of their wages while they’re on leave.

- Decide if an employee is eligible for benefits. The FAMLI Division will decide.