All employers with Colorado employees must update their total employee headcount for 2025 in My FAMLI+ Employer by February 28, 2025.

This will ensure your business is paying accurate FAMLI premium rates. It’s a requirement for all employers with Colorado employees, even those that have been approved to use a private plan to meet their FAMLI obligations. The only exceptions are local government employers who have voted to opt out of the program.

NEW this year: If your Annual Total Employee headcount is not updated by February 28, 2025, the FAMLI Division will assume you have 10 or more employees, and you’ll be required to send in 0.9% of wages each quarter in 2025.

This means that if an employer had nine or fewer employees for 2024, they MUST update their headcount for 2025 to continue paying 0.45%. We won’t carry over your total headcount from the previous year.

As a refresher, employers with 10 or more employees are required to send in 0.9% of wages every quarter, and those with nine or fewer employees will be responsible for sending 0.45% of wages. Employers of any size have the option of deducting up to 0.45% of wages from employees to cover their required premium liability.

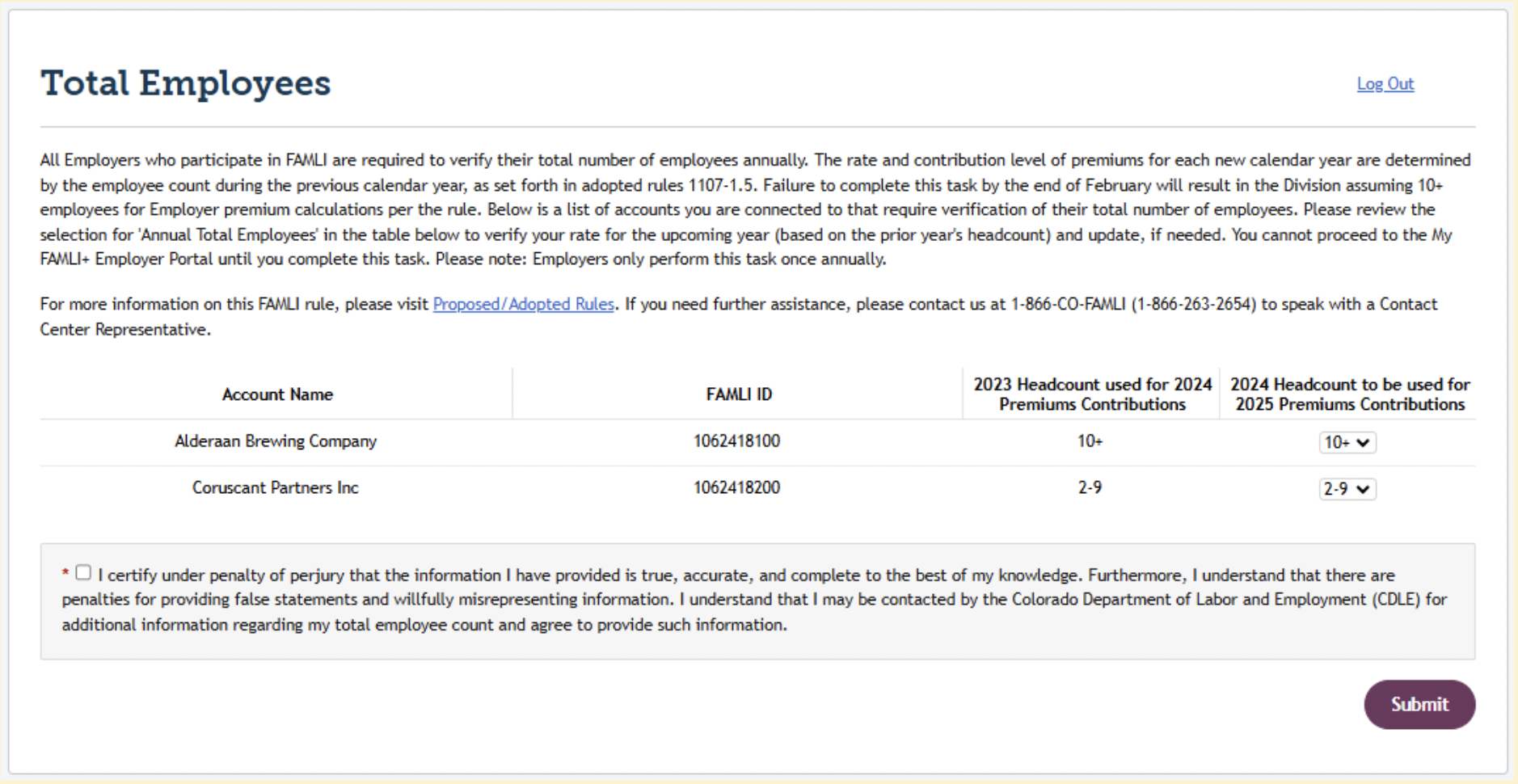

Log in to your My FAMLI+ Employer account, and you will find the task on your dashboard.

The My FAMLI+ Employer portal will provide the headcount used in 2024, and employers can simply update that number for 2025. Here’s how it will look:

Not sure how to count employees? Here’s a handy refresher:

Your total headcount will be calculated by counting the number of employees you have on your payroll nationwide for a total of 20 or more calendar workweeks in the preceding calendar year.

The graphic below shows this 20-calendar-week concept in four examples:

Visit famli.colorado.gov/employers for more help in determining your employee headcount.

The Annual Total Employees headcount needs to be completed by employers. Third party administrators are not able to complete this task on behalf of their clients or through bulk upload.

If you have any questions about your obligations to update your employee headcount, we are standing by to help. Call us at 1-866-CO-FAMLI (1-866-263-2654) any weekday between 7:30 a.m. - 4:30 p.m. MT. We also have several online resources including the My FAMLI+ Employer user guide and several how-to-videos, file specifications, and sample templates to help you along the way.