As the days get longer and Colorado employers start staffing up for summer, experts from the new Family and Medical Leave Insurance (FAMLI) program are out in the community to explain how the program will work for temporary and seasonal employees.

FAMLI experts met recently with Colorado members of the Society for Human Resource Management to answer questions about FAMLI requirements. Meeting at the Colorado History Museum, one of the top questions from Mile High SHRM members was about summer interns and other seasonal workers.

Several employers wondered about summer interns they planned on hiring in 2023. Would they be eligible for FAMLI benefits?

The answer: It depends.

Employees are eligible to take paid family leave after they have earned at least $2,500 in wages within Colorado, over a period of a year.

So if an intern comes from out of state and earns less than $2,500 over the course of the internship, that intern would not be eligible for FAMLI leave. After earning $2,500, an intern would be eligible. They would also be eligible if they had earned $2,500 in wages from any job in Colorado during the base period before they apply for FAMLI benefits. The base period we use to determine FAMLI benefit payments is roughly the year before a FAMLI leave period would begin.

So what is an employer’s responsibility for short-term and seasonal workers? That also depends.

No matter what, all employers will owe 0.45% of each employee’s wages to the FAMLI Division, regardless of how long that employee works. To find out how to submit those wage reports and premiums, employers can check out all our tools at My FAMLI+ Employer.

Things get more complicated when it comes to employers also owing the 0.45% wage share. That’s because employers owe 0.45% only if they have 10 or more employees.

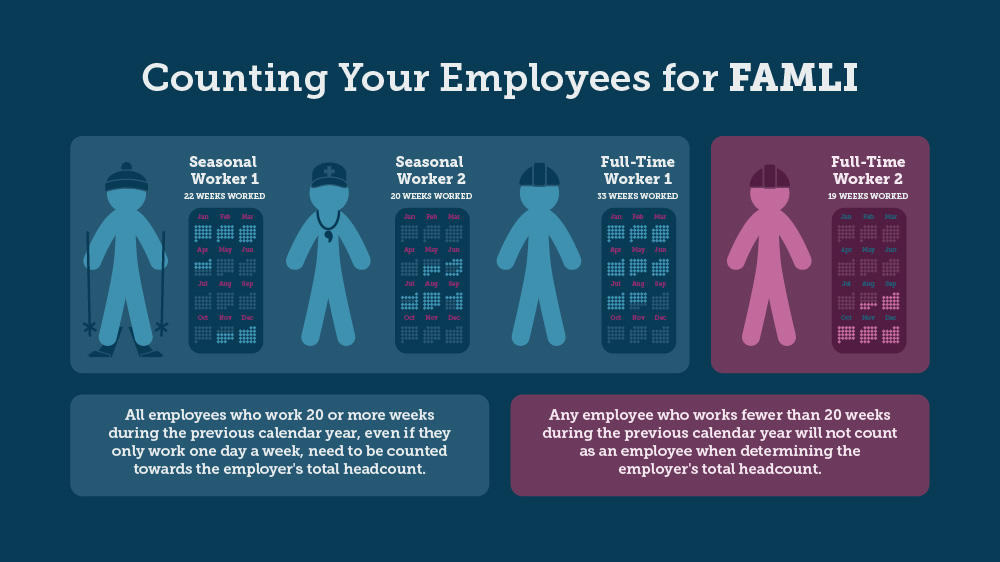

Do seasonal employees count? Maybe. Employers must count employees who worked 20 or more weeks during the previous calendar year, no matter how many days per week they worked.

If an employer comes up with more than 10 employees in the previous calendar year, they owe the employer share of 0.45% of wages even for temporary and seasonal workers. For employers with fewer than 10 employees in the previous calendar year, the employer doesn’t owe any employer share no matter how long employees worked, but the employer will still need to deduct and remit the 0.45% employee share on behalf of those employees as long as they are on the payroll.

Here’s a chart to help explain how to count seasonal workers.

FAMLI experts are standing by to help all Colorado employers figure out their FAMLI obligations. Drop us a line at CDLE_FAMLI_info@state.co.us or give us a call at 1-866-CO-FAMLI any weekday between 8 a.m. and 4 p.m. MT and we’ll help you figure out the required payments for your unique situation.