What happens in your workers' lives can impact your business at any time. Car accidents, serious illnesses like cancer, welcoming a new child — some life events do not wait until we are ready for them. The FAMLI program can help you be ready to rise to the occasion when your employees need you the most.

Employers and their employees are both responsible for funding the program and may split the cost 50/50. The premiums are set to 0.9% of the employee’s wage, with 0.45% paid by the employer and 0.45% paid by the employee. Employers may also choose to pay the full 0.9% as an added benefit for their employees.

Businesses with nine or fewer employees are only responsible for deducting and sending in the 0.45% of their employees' share of premium on their behalf each quarter. These small businesses may also choose to pay the 0.45% on behalf of their employees.

All businesses with at least one qualified employee are required to register with the FAMLI Division in My FAMLI+ Employer. Self-employed individuals, or sole proprietors with no employees, are not required to register.

Regardless of your business structure, if you have at least one qualifying employee, you will need to register with the FAMLI Division, submit wage data and send in premiums on behalf of that employee. Visit our Individuals and Families page for more information on the options for self-employed individuals. Small businesses can also check out our Small Business Guide to FAMLI if you are still unsure about whether or not you have qualifying employees.

Use our premium and benefits calculator to estimate your premiums.

Premiums are paid on wages up to the Federal Social Security Wage Cap ($168,600 for earnings in 2024). Benefits are calculated on a sliding scale using the individual's average weekly wage from the previous five calendar quarters in relation to the average weekly wage for the state of Colorado ($1,471.34 as of July 2024) and may increase over time.

Disclaimer: these calculations should only be used as estimates and may not be equal to the exact amount of your premium or benefit payment.

FAMLI Benefits are now available and businesses are collecting premiums through a simple payroll deduction.

Most Colorado businesses should be deducting FAMLI premiums from all employees on their payroll, including full-time, part-time, and seasonal. Employers cannot collect missed premiums from employees in later pay periods. It is important to know employees are never required to pay more than 50% of the total premium.

By law, the FAMLI Division Director is required to recalculate the premium rate every year past 2025 and determine if adjustments to the premium rate need to be made. Current Colorado law caps the premium at 1.2% meaning it will not be assessed any higher than this amount.

Important FAMLI Matters

- Definition of Wages

The definition of wages under FAMLI, “wages” means “gross wages” and includes typical employer compensation. In other words, the amount that is listed on an employee’s pay stub as “gross wages” is the amount used to calculate the FAMLI premium deduction amount (0.45% of an employee’s gross wages.)

Gross wages include the following:

- Salary

- Hourly wage

- Overtime

- Tips

- Bonus

- Commissions

- Piece rate

- Employer-provided paid leave (PTO, sick, vacation, etc.)

- Disability benefits paid by the employer and not by a third-party

- Parental leave paid by the employer and not by a third party

- The value of lodging or meals used as a credit toward the minimum wage

Gross wages do NOT include:

- Severance payments

- Employer contributions to, or payouts from, a deferred compensation plan

- Profit-sharing

- Pensions or retirement plan payments

- Expense reimbursements (mileage, travel, moving, per diems, etc)

- Non-monetary payments (except lodging or meals to the extent they’re used as a credit toward the minimum wage)

- Determining Your Employee Headcount

When it comes to counting how many employees your business has, your headcount will be calculated by counting the number of employees you have on your payroll for a total of 20 or more calendar workweeks in the preceding calendar year. Employers will report their headcount during the initial registration process and once a year thereafter during the first quarter of each year.

Businesses that report having ten or more employees who worked during 20 or more weeks during the previous full calendar year will be responsible for sending in the full 0.9% premium for all four quarters.

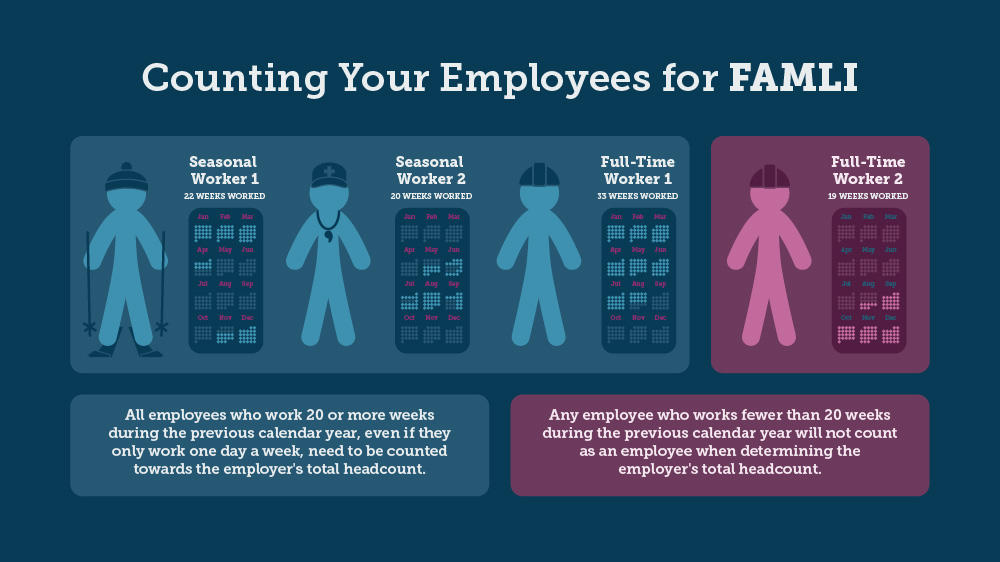

The graphic below visualizes this 20-calendar-week concept in four examples.

The first two employees are seasonal workers who both work during 20 or more weeks throughout the calendar year. Note that they both work intermittent schedules throughout the year and may only work one or two days during some work weeks, but they are still included in your headcount.

The third full-time worker worked for more than 20 weeks, so would also be counted, even though you can see this worker left the company in August.

The final full time worker in the red box, let’s say this worker was hired to replace the previous one, would not count toward your total headcount because he only worked during 19 weeks of the year.

It’s important to note that employers are responsible for deducting and remitting premiums for every employee as soon as they are hired. This 20-week concept should only be used to determine whether or not your business is categorized as having 10 or more employees and thus responsible for sending in the full 0.9% premium once a quarter.

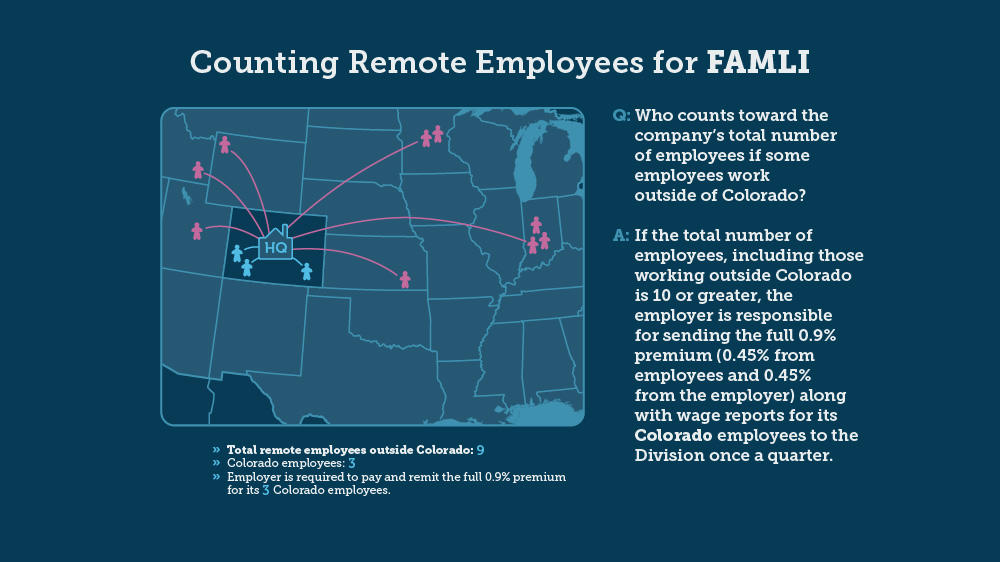

- Counting Remote Employees

When it comes to counting remote employees, if the employer has more than ten TOTAL employees – even if they work outside of Colorado – the employer is still responsible for sending in the full 0.9% premium once a quarter.

In the example below, the employer is responsible for both the 0.45% employee share and the 0.45% employer share for the three employees who work in Colorado because it has 12 total employees.

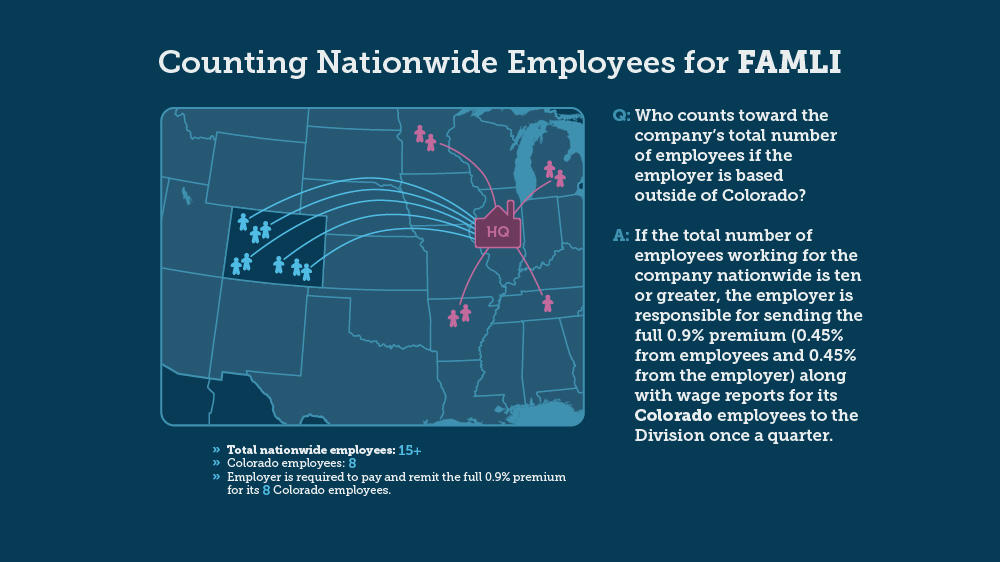

- Employers with Nationwide Employees

National employers that have employees based all over the country need to use their total employee headcount to determine their premium responsibility for their Colorado-based employees.

As you can see on the map below, the employer has 15 total employees, so it is required to send in the full 0.9% premium for the eight employees who are based in Colorado.

Question 1: Does the employee work entirely within Colorado?

- If YES, the employee is covered under FAMLI.

- If NO, go to Question 2.

Question 2: Does the employee work SOME within Colorado?

- If YES, go to Question 3.

- If NO, the employee is NOT covered under FAMLI.

Question 3: Does the employee work PRIMARILY within Colorado?

- If YES, the employee is covered under FAMLI.

- If NO, go to Question 4.

Question 4: Does the employee work PRIMARILY within ONE other state BESIDES Colorado?

- If YES, the employee is NOT covered under FAMLI.

- If NO, go to Question 5.

Question 5: Does the employee have a base of operations?

- If YES, go to Question 6.

- If NO, go to Question 7.

Question 6: Is the employee's base of operations Colorado?

- If YES, the employee is covered under FAMLI.

- If NO, the employee is NOT covered under FAMLI.

Question 7: Does the employer direct the employee's work from Colorado?

- If YES, the employee is covered under FAMLI.

- If NO, go to Question 8.

Question 8: Does the employer direct the employee's work from a state where the employee also works?

- If YES, the employee is NOT covered under FAMLI.

- If NO, go to Question 9.

Question 9: Is the employee's residence in Colorado?

- If YES, the employee is covered under FAMLI.

- If NO, the employee is NOT covered under FAMLI.

When determining whether the employee works primarily in Colorado or some other state, it is not sufficient to determine the amount of time they work in a state. An employee works primarily in a state only if the work performed outside that state is incidental to the work performed inside the state, or if the work performed outside the state is temporary or transitory and consists of isolated transactions. It is possible that an employee does not work primarily in any state.

- Paying Your Premiums

Premium payments and wage reports are due on the same schedule as is typical with Unemployment Insurance. Payments are due on the last day of the month following the end of each quarter. The 2024 schedule is:

- Q1: March 30, 2024

- Q2: June 30, 2024

- Q3: September 30, 2024

- Q4: December 31, 2024

Employers have several payment type options to submit their quarterly premium payments to the FAMLI Division:

Online Payment through the My FAMLI+ Employer Portal

Employers and third party administrators can make payments online directly in the My FAMLI+ Employer portal. You will need to provide your bank account’s routing number and account number. Payment instructions can be found in the My FAMLI+ Employer User Guides for both Employers and TPAs.

Online Bill Pay

Employers can make electronic payments from a checking account using Online Bill Pay.

If your bank offers this functionality, you will log into your bank’s website to add FAMLI as a payee using the following information.

- Payee Name: Division of Family and Medical Leave Insurance

- If this is too long, you may also enter “Colorado FAMLI”

- Address: PO BOX 5070, Denver, CO 80217-5070

- Phone Number: 866-263-2654

- Account Number: enter your 10-digit FAMLI Employer Account Number

Once FAMLI is setup as a payee, you can initiate a one-time payment from your bank’s website.

Payment via API

If you are a software developer looking to allow your users to make electronic payments to FAMLI from your software, please email cdle_famli_info@state.co.us with your request. Please enter “API Access Request” as the subject and details on what you are trying to accomplish.

Interested parties can learn about API and its integration by visiting this website.

Payment by ACH Credit

Employers and third party administrators (TPAs) can also make payments by issuing an Automated Clearing House (ACH) Credit through their bank. This payment option is available to employers and TPAs who meet all of the following prerequisites:

- Have already established ACH credit payment processes through their bank.

- Are already familiar with National Automated Clearing House Association (NACHA) file formats and can support the ACH Cash Concentration and Disbursement Plus One Addenda Record (CCD+) format.

- Can include the required ACH addenda detail formatted in the FAMLI-defined format to ensure your payment credits your FAMLI account. Please refer to the FAMLI ACH Credit Specifications.

Direct your bank to issue an ACH Credit payment to FAMLI:

- Routing Number: 021052053 (Receiving DFI Identification)

- Account Number: 72878553 (DFI Account Number)

TPAs can make ACH Credit payment on behalf of multiple employers. TPAs must follow FAMLI’s ACH Credit Specifications to ensure each employer’s account is credited correctly.

Payment by Check

Employers can mail in their payments by issuing a check paid to the order Of “Division of Family and Medical Leave Insurance”.

To ensure the payment credits their FAMLI Employer Account, employers must either:

- Write in their 10-digit FAMLI employer account number in the Memo of the check,

- Or, download and print out the Remittance Note from the My FAMLI+ Employer portal, and include it with your check. Instructions to download the Remittance Note can be found in the My FAMLI+ Employer User Guides for both Employers and TPAs. Mail the check and any supporting documentation to the following secure PO Box address:

Division of Family and Medical Leave Insurance

PO BOX 5070

Denver CO 80217-5070

While payments that are postmarked on the due date will be considered timely, we recommend that employers mail check payments at least 10 business days before the payment due date.

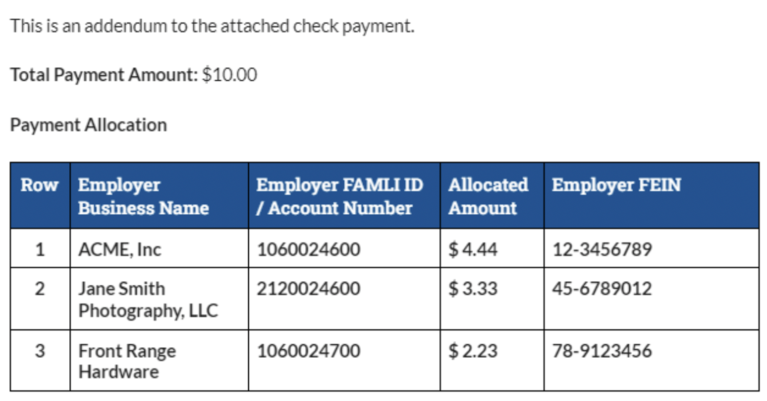

If you are a third party administrator paying on behalf of more than one employer with a single check, please include with the check a document with the following information:

- Each employer’s business name

- Each employer’s 10-digit FAMLI Account Number

- Amount allocated to each employer from the total check payment amount

- Employer’s FEIN or other identification number (ITIN or SSN)

The following image is an example of what that document could look like:

If you need to add the Division of Family and Medical Leave Insurance as a vendor in order to send payments to the Division, our W-9 is available.

A Note on Accessibility

We at FAMLI strive to make all of our digital products as accessible as possible, but if you have problems accessing our content, please visit our accessibility page to get the help you need.

- Submitting Your Wage Reports

Employers are required to submit wage data to the Division once a quarter. This will determine the employer’s total premium payment for the quarter. All of this is done using our online employer services portal, My FAMLI+ Employer.

Within My FAMLI+ Employer, employers have options to submit wage data to the Division:

- Manually input wage data for each employee individually.

- Bulk upload wage data for all employees by uploading a file within My FAMLI+ Employer. Please refer to our Wage Reporting File Specifications and use one of the following single filer wage report sample templates to build your wage report files:

- Submit wage reports using API technology. Please refer to our Wage Reporting API Specifications for instructions.

- Employers with Approved Private Plans

Private businesses have the option of using an approved private plan that offers the same or greater benefits and protections as the FAMLI program. Employers that would like to offer a private plan (including self insurance models) are not exempt from paying FAMLI premiums until the FAMLI Division has reviewed and approved the private plan or self insurance documentation in accordance with the Division’s private plan regulations.

All employers must register with the FAMLI program. Employers can request a refund for premiums paid in 2023 if they get a private plan approved by the Division with an effective date on or before January 1, 2024.

If you have additional questions, you can find the private plan rules here.

- FAMLI for Self-Employed Workers

Most Colorado workers are eligible for FAMLI benefits, including self-employed individuals and independent contractors. Participation for self-employed workers is optional.

- Self-employed individuals who do not wish to participate in FAMLI do not need to take any action to opt out of the program.

- Self-employed individuals who want to participate: need to opt into FAMLI and must agree to participate by paying premiums and reporting your income for a minimum of three years.

There is no enrollment period for self-employed workers. You can opt in and apply for leave any time. No action is required until then.

- FAMLI and Taxes

FAMLI premiums are deducted AFTER taxes and do not reduce an employee’s taxable income. Premiums are based on a post-tax basis, per the Department of Revenue. Employers should report premium deductions on IRS form W-2 in Box 14, and list “FAMLI” as the label.

FAMLI benefits are not subject to state income tax; however, the FAMLI Division cannot provide advice on federal taxation.

The FAMLI Division will issue a 1099-G form to claimants who receive benefits.

Responsibilities Under the FAMLI Statute

| Employer Type | Employer Premium | Employee Premium | No Premium |

|---|---|---|---|

| 9 or fewer employees | |||

| 10 or more employees | |||

| Voluntarily Participating Self-Employed | |||

| Participating Local Government Employer | |||

| Voluntarily Participating Local Government Employee | |||

| Local Government Employer who has Voted to Opt Out | |||

| Nonparticipating Self-Employed | |||

| Employer with Approved Private Plan |