Colorado does not tax FAMLI benefits.

Current IRS guidance suggests that state programs like FAMLI are taxed similar to unemployment compensation, which is subject to federal income tax.

The FAMLI Division cannot provide advice on federal taxation. That’s why FAMLI is giving claimants the option to decide whether or not to have federal taxes withheld. Starting in January, claimants will be able to choose whether they’d like the FAMLI Division to withhold federal income tax from their benefits.

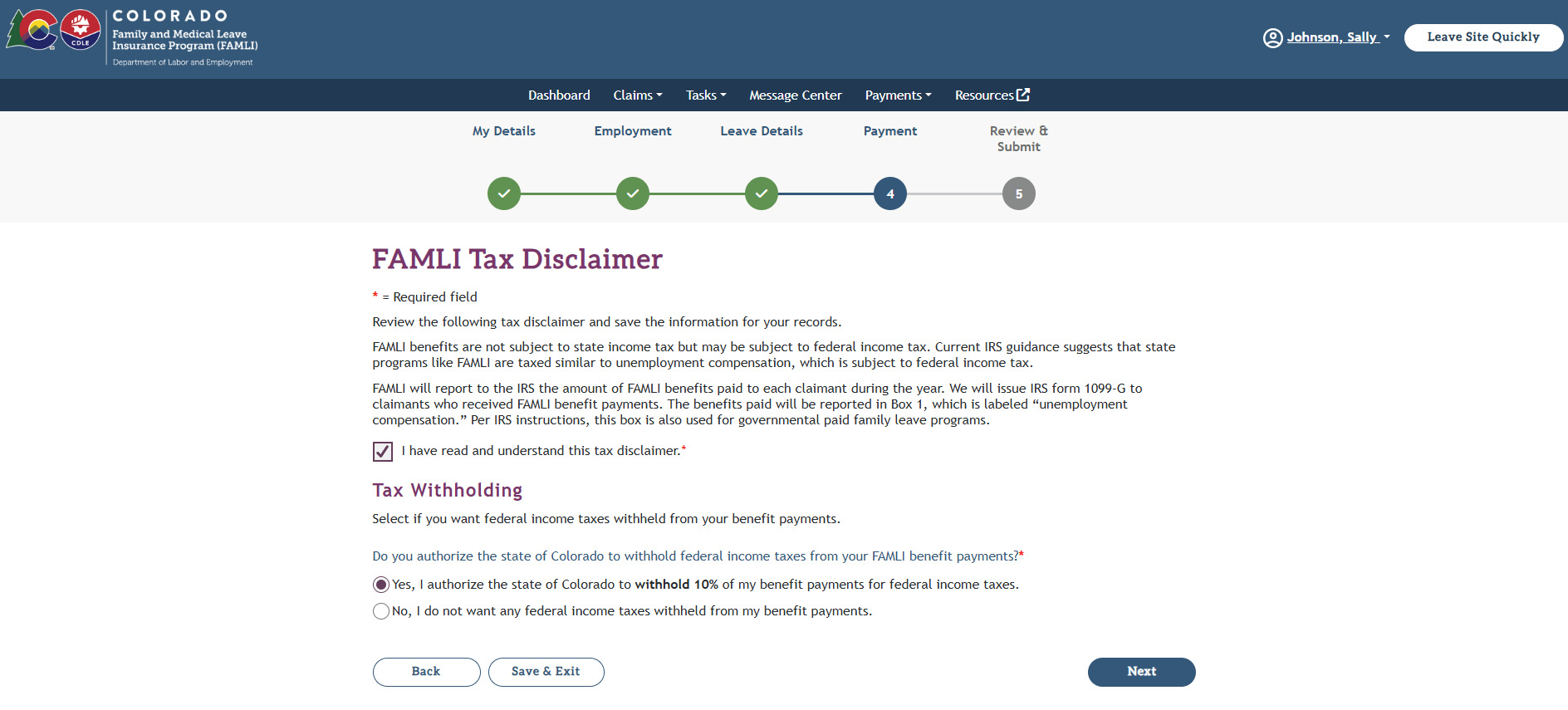

This will be a simple opt-in or opt-out option, with the rate being set at a flat 10%.

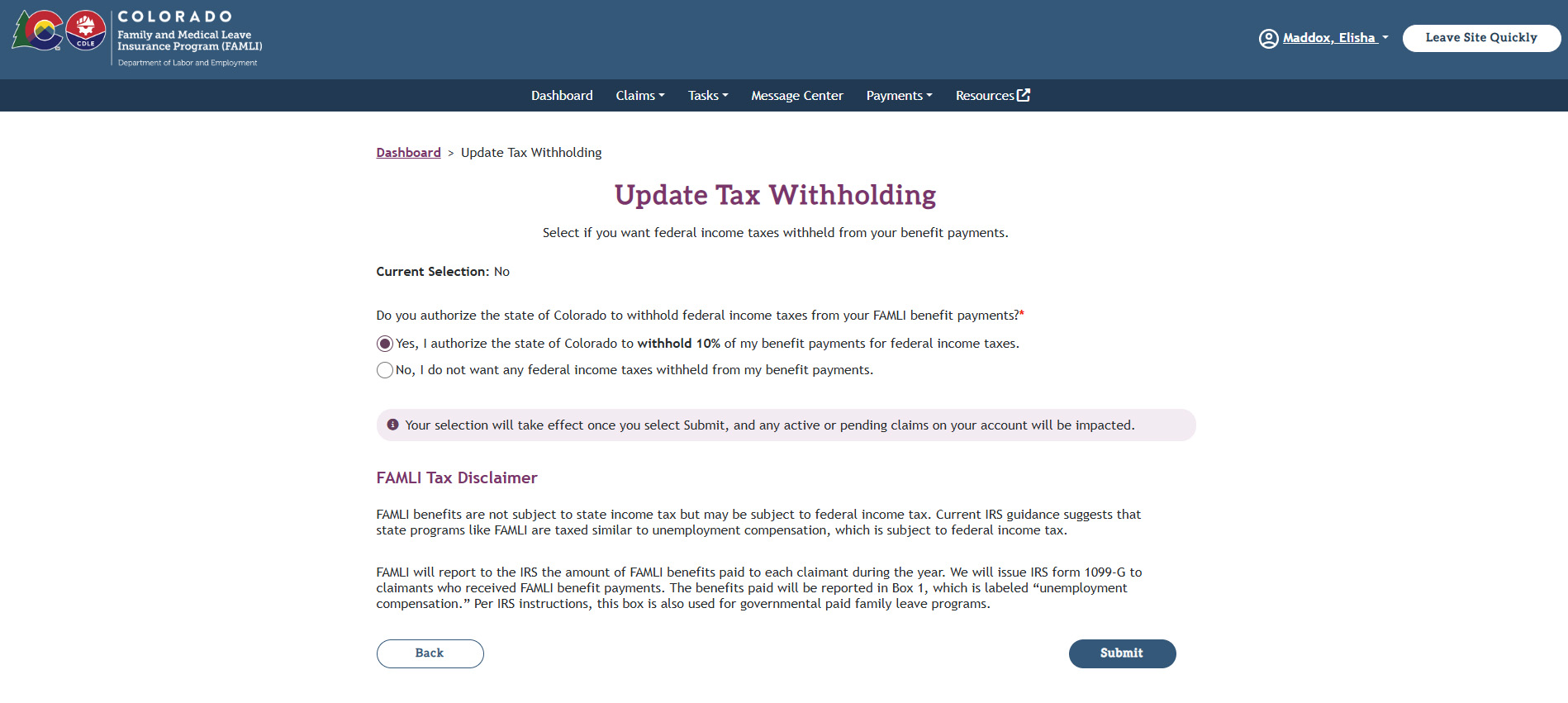

Active claims won’t change, though active claimants will have the option to change their tax preferences in their Payments Dashboards in the My FAMLI+ portal. Here's what that will look like:

If you decide to have federal taxes withheld, the funds will automatically be withheld from all future payments, and FAMLI will send the withheld amount on their behalf to the IRS.

You can change your decision at any point for future payments (but you won’t be able to retroactively collect funds that previously were withheld).

Here’s what both employers and claimants need to know about FAMLI and taxes:

- FAMLI premiums should be considered post-tax deductions that do not reduce an employee’s taxable income.

- Employers should report such deductions on IRS form W-2 in Box 14, and list “FAMLI” as the label.

- The FAMLI Division will issue IRS form 1099-G to each employee who receives FAMLI benefits, and the benefits paid will be reported in Box 1, which is labeled “unemployment compensation.” According to IRS instructions, this box is also used for governmental paid family leave programs.

- In case of a FAMLI overpayment, in which case a claimant must repay some funds, note that any amount the claimant pays towards the overpayment is not accounted for on 1099-Gs. All FAMLI payments from the prior tax year are shown in Box 1 of the 1099-G. Here’s a possible example: The FAMLI Division paid you a total of $5,000 last year, but then determined that you were eligible for just $4,500 and ordered you to repay $500. In that case, your next 1099-G would show $5,000 originally paid to you instead of $4,500.

- 1099-Gs will be mailed to claimants in January. You’ll also find your 1099-G form in your My FAMLI+ portal in late January.

Remember: Active claimants will have this new option starting on January 2, 2025. Anyone who applies for FAMLI on or after January 2, 2025 will make this selection during the application process. Here’s what that will look like: